Every year, the celebration of World Financial Planning Day raises awareness about the importance of financial planning. It is an opportunity for financial advisers and wealth managers around the world to educate consumers on how to manage finances – building security, confidence, and peace of mind.

Led by the Financial Planning Standards Board (FPSB), the initiative encourages individuals to seek professional guidance and make informed decisions about saving, investing, and protecting their financial wellbeing. Read more on the campaign here: https://fpsb.org/news/world-financial-planning-day-returns-8-october-to-help-people-build-brighter-futures/

The evolution of financial planning

Financial planning has come a long way from the days of traveling miles for face-to-face meetings, spending hours completing printed forms, and waiting several days, if not weeks, for postal exchanges. Today’s clients expect convenience, clarity, and control over their finances – without compromising on trust or compliance.

Modern financial advice has been enhanced by hybrid interactions:

- Virtual meetings instead of physical appointments

- Secure document sharing instead of bulky paper files

- Real-time updates and digital signatures replacing days of back-and-forth

This evolution has enabled advisers to work more efficiently, expand their reach beyond geography, and offer faster, more transparent service to clients. However, as technology advances, so do client expectations. The challenge now is balancing digital convenience with personal connection and regulatory confidence.

Building trust in a digital world

Trust remains at the centre of every financial planning relationship. While technology can streamline processes, the human element – empathy, understanding, and professional judgement – is irreplaceable.

That’s where secure, client-centric digital tools can support the advice process, by enabling planners to spend more time with their clients, and less on administrative tasks.

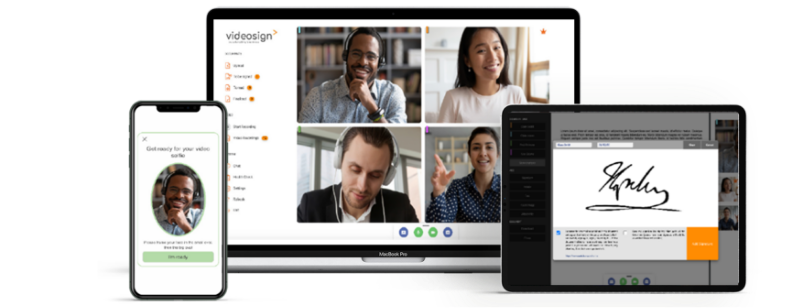

Videosign was developed with this balance in mind – combining the convenience of digital signing with the reassurance of real human presence.

The six stages of financial planning

According to the Financial Planning Standards Board, the financial planning process typically follows six key steps. Each stage requires both collaboration and clear communication between adviser and client – and Videosign helps make that interaction seamless, secure, and efficient.

Step 1: Establish and define the professional relationship

The first step is about setting expectations, outlining services, and agreeing on the scope of engagement.

How Videosign helps: Host your initial consultation in a secure video meeting, clearly record the written scope and terms of engagement and capture a signed Letter of Authority (LOA) – all within one platform.

Step 2: Collect client information

Gathering detailed financial and personal data is essential for developing an accurate plan.

How Videosign helps: Discussions around the client’s goals can take place, and be recorded, within the Videosign meeting room.

Step 3: Analyse and evaluate the client’s financial status

Here, advisers assess the client’s current position, opportunities, and challenges.

How Videosign helps: Use of screen sharing via Videosign to review financial statements or projections together, while maintaining a clear audit trail of what was discussed through video and meeting records. Clients can also upload documents securely via Videosign for the adviser to review remotely.

Step 4: Develop and present financial planning recommendations

Once analysis is complete, advisers propose tailored strategies and recommendations.

How Videosign helps: Present your recommendations in real time, discuss options face-to-face via video, and obtain immediate digital sign-off on draft or final plans – reducing delays and improving engagement.

Step 5: Implement the financial planning recommendations

After agreement, actions must be taken – whether setting up investments, insurance, or other arrangements.

How Videosign helps: Use Directsign to issue implementation documents quickly and securely. Schedule any quick catch-up meetings or follow-ups easily via the Meeting Manager.

Step 6: Review the client’s situation

Financial planning is an ongoing process. Regular reviews ensure the plan stays aligned with life changes and market conditions.

How Videosign helps: Schedule and host review meetings through Videosign, allowing clients to sign updated documents or revised strategies on the spot, with every action captured in the audit trail.

Real-world results

Earlier this year, we featured a case study with a UK financial adviser who implemented Videosign to streamline their onboarding and agreement processes.

By moving to video-based signing, they:

- Reduced turnaround time for signed documents

- Cut down on client follow-ups and delays

- Strengthened their compliance recordkeeping

- Gave clients more confidence in their digital journey

You can read the full case study here: https://www.videosign.co.uk/2025/05/06/how-one-financial-adviser-transformed-his-client-experience-with-videosign/

Looking ahead

As we celebrate World Financial Planning Day, it’s clear that delivery of financial advice continues to evolve from traditional methods to fully digital, hybrid client experiences that prioritise both efficiency and empathy.

By adopting secure and innovative tools like Videosign, financial planners can continue to combine technology with trust to help their clients make better financial decisions.

If you’re an adviser interested in how Videosign can streamline your financial advice process, get in touch today!