Steven Tallant, CEO of Videosign joined a team of tech experts to meet with Pensions Minister Guy Opperman and offer ideas for pensions and financial inclusion.

The session took place at the Citywire Studios recently with the focus on how fintech companies can help the general public and Department for Work and Pensions (DWP).

Steven was on the fintech panel alongside:

- Ian Beestin: chief product officer from Money Alive

- Kate Bohn: innovation and strategy, accelerator and incubator lead from Lloyd’s Banking Group

- Simone Koo Ishikawa: fintech mentor and angel investor to a wide range of fintech companies

- David Stamp: managing director of Centology

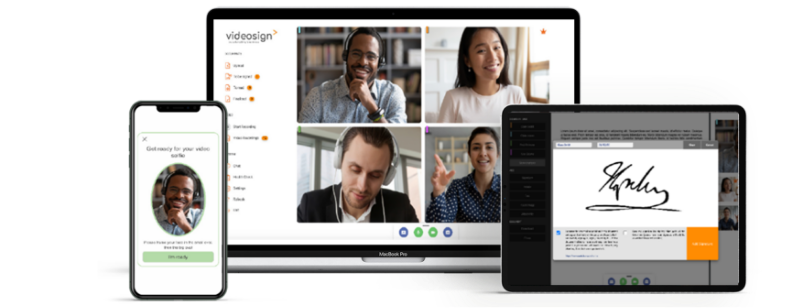

Steven discussed how Videosign can allow people to sign contracts remotely and record video evidence of the signature, the witness and the intent. He explained how the layout is akin to a video call, and that Videosign makes use of facial recognition and IP addresses to verify attendees, and spoke how the tool had been built to comply with the stringent regulatory demands of the legal and financial sectors “It is about protecting the consumer, but also the business that is providing a service. The problem is that people aren’t quite there yet. Everybody agrees that this is the future’.

Read the full article online – please note that Citywire requires registration (free).